CPA Salary in India and USA: Average to Highest: 2023

Although they’re both qualifications for finance professionals and the preparation required for each certification is similar, the knowledge base is slightly different. For example, the CFA exam covers topics like economics, financial analysis, and corporate finance, whereas the CFP exam covers topics like risk management, retirement planning, and estate planning. As chartered members proceed further in their careers, it’s apparent from the job type and industry experience breakdowns that the CFA salary in India continues to pay dividends. The more years of experience you have, the more valuable your CFA charter becomes. A CFA charter holder earns more than a finance MBA employee on average. In the city-by-city analysis, we see that financial firms in Mumbai and Gurgaon reward their employees for a greater cost of living than the national average.

Companies in many areas have also hired analysts rather than depending on external staff to undertake financial research in some circumstances. Since Certified Public Accountant is an advanced accounting profession, there are several career opportunities to explore based on your level of expertise. Some of the most preferred career options after successfully completing a US CPA are Tax Advisory and Planning, Auditing Services, Management and Consulting Services, Forensic Accounting, Financial Reporting, etc. Here’s a glimpse into the salaries offered to US CPAs based on the profession they choose.

CMA vs CFA – Benefits of Pursuing

Your salary after CFA may largely depend on the kind of work experience you have and your academic qualifications. Moreover, even after you start working as a financial analyst, the trajectory of growth you experience and your salary package depends on your skills in finance and the kind of impression you make on your peers. The primary difference between the CPA and CFA is that the CPA is an accounting credential, while the CFA is for financial analysis.

- One focuses on investment analysis while the other works on financial records keeping.

- Moreover, there are so many free online resources available online, which can help students steer their planning in the right direction.

- However, if you are passionate about Financial Analysis and want to pursue it as a career, CFA is the best fit.

- Many consider the CPA to be the highest achievement across both accounting and finance—and the “gold standard” of the profession.

- Similarly, Levels II and III are now offered in May, August, or November.

Henry Harvin has a 9-1 program which encompasses training, certification, internship, placement, etc making the US CPA preparation a much more effective and satisfying journey for the trainees. Clearing CFA level 3 guarantees you a spot in the finance industry’s top jobs. Every job profile falls inside one’s scope of operations, from obtaining money to managing it, investing it, examining it, and finally cpa vs cfa salary in india divesting it. People with prior experience can advance in the same area of operation, while those new to the game can still claim a strong start. After finishing CFA level 3, you are directly eligible for positions such as investment banker, portfolio manager, risk manager, market research analyst, and private banker. Skilled CAs are always in demand in the financial and manufacturing industries.

Forgot password?

As a result, India benefits from favourable globalisation and beneficial investment technology trends. One of the most important factors in India’s financial industry is there is ample opportunity for growth. CFA in India is drawing many candidates due to the certainty of absorption in the rising financial industry. Both professions require patience, hard work, and sincerity, and they’re both important jobs in their own right. Being at the top of your game in either field will bring you a lot of respect in society.

According to data from the CFA Institute, just 7% of CFA Charter holders become Chief Executive. Many other positions exist, such as Risk Managers, Consultants, Auditors, and Advisers, although their starting salaries vary based on their expertise and industry. CFA Salary in India for freshers is around ₹50,000 per month in cities like Mumbai, Gurgaon, and Hyderabad.

CFA vs CMA – Which is Better?

As a professional certification, the Chartered Financial Analyst profession opens up numerous career opportunities. ACCA( Association of Chartered Certified Accountants) is the world’s leading and fastest-growing international accountancy organization which provides high standards of employee learning and development. ACCA provides you skills and knowledge about all areas of business, financial statements, management accounting, business taxation, and also business ethics.

Bookkeeping Vs. Accounting: Which Path Is Right For You? – Forbes

Bookkeeping Vs. Accounting: Which Path Is Right For You?.

Posted: Wed, 30 Nov 2022 08:00:00 GMT [source]

Once you’ve cleared all your CA papers and are done with your articleship training, you can choose to practice Chartered Accountancy anywhere in India, UK, UAE and Singapore. On completion of your CFA course, which is a 2 to 3 year course comprising three levels, you can choose to work as a Financial Analyst in more than 165 countries. CFA and CMA are highly specialized certifications that have many advantages in the job market. Students who complete this course have a great competitive advantage over other students in the field of finance. The Chartered Financial Analyst is a reputed designation in the market. It with-holds high-end responsibilities and thereby pays an exciting salary.

What is the career scope after CFA?

In this article, we will be going through various questions often asked by students regarding both finance certifications. Concerns like “CFA vs CPA salary in India”, “Which of them is easier?”, “Which of them gives the better return?”, etc will all be satisfied. Students must analyze the pros and cons of each with care before deciding a career path that they are interested in and are passionate about.

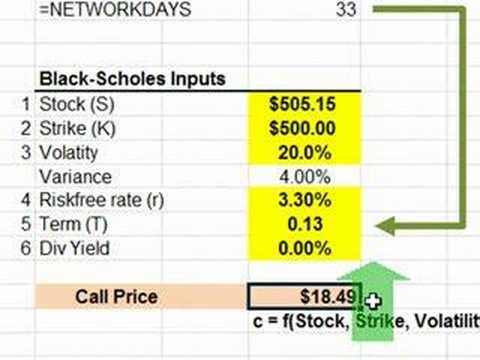

However, as of now, most candidates take four years to complete the exams. The following is a compensation breakdown for the many positions that Chartered Financial Analysts can pursue after receiving their certification. The average salary of CFA in India is ₹5 lakh per year, with the greatest compensation a CFA may earn being close to ₹20 lakh. Salaries can vary widely for both CFAs and CPAs based on location, experience level, and company size.

In India, a CFA certification can provide a deeper understanding of financial analysis, risk management, and investment strategy, leading to career growth and increased earning potential. Gaining a CPA license (and a CPA salary) extracts a tremendous investment of time and energy not to mention a desire for continuous learning. Many government and private educational institutes in India are providing both online and offline CPA courses.

Average Salary Based on Profiles in India

This makes it look as though the exams are of approximately equal difficulty. For the last decade, the CFA pass rate averages were 41% for Level I, 44% for Level II, and 53% for Level III. This would suggest that the CFA exam has historically been more difficult. Additionally, while opinions differ, some people who have taken both think that a current CPA would have a harder time passing the CFA exam than vice versa.

A CA typically advises about financial records and audits accounts and gives other trustworthy information to key stakeholders about the company’s finances. NorthStar Academy (NSA) offers comprehensive guidance for preparing for certification exams, including CPA and CMA USA. Whichever professional certification you may pursue among CPA vs CMA vs CFA, it is better to choose one that will benefit you most while conforming with your interests and preferences. If you are interested in making a career in Management Accounting & Finance, you should go for CMA USA. If you are interested in Accountancy, CMA USA and CPA are excellent choices. However, if you are passionate about Financial Analysis and want to pursue it as a career, CFA is the best fit.

CFA vs CPA Exam Difficulty

As specified above, they can work in auditing, taxation, assurance, and advisory fields in the Big Fours, accredited international firms, and other local firms. After the pandemic, there are certain industries that are gaining more popularity than the others such as food, healthcare, and EdTech. Apart from the job’s repute and ethics, the salary is the most prominent aspect of a CPA role. It has been found in various reports that a CPA certificate holder earns 10-15% more on an average than other fellow accountants.

- With the help of the US CPA certification, licensed CPAs can fill the job roles of auditors, accountants, forensic accountants, tax professionals, and even of Chief Financial Officers (CFOs).

- CFA Institute Prep Providers are forbidden from including CFA Institute official mock exam questions or any questions other than the end of reading questions within their products and services.

- For those who are looking for careers as equity analysts, fund managers, and professionals in asset management or hedge fund houses, this is the best title you can get.

A late-career CPA also stands to earn nearly $40,000 more a year than a late-career accountant. In general, CPAs tend to earn more respect, career security, and job satisfaction, as well. When deciding whether to go for CPA or CFA, the first and foremost consideration is the relevance to your career.